10 Simple Techniques For Estate Planning Attorney

10 Simple Techniques For Estate Planning Attorney

Blog Article

Things about Estate Planning Attorney

Table of ContentsThe smart Trick of Estate Planning Attorney That Nobody is DiscussingLittle Known Questions About Estate Planning Attorney.Indicators on Estate Planning Attorney You Should KnowSome Known Details About Estate Planning Attorney

Your lawyer will likewise assist you make your papers authorities, preparing for witnesses and notary public trademarks as essential, so you do not need to stress about trying to do that last action on your very own - Estate Planning Attorney. Last, yet not the very least, there is useful assurance in establishing a connection with an estate planning attorney that can be there for you in the futureJust put, estate preparation attorneys offer worth in lots of methods, far past simply providing you with published wills, depends on, or other estate intending papers. If you have questions concerning the procedure and want to find out a lot more, contact our workplace today.

An estate planning lawyer helps you define end-of-life decisions and lawful papers. They can set up wills, develop counts on, develop health and wellness care regulations, establish power of lawyer, create sequence strategies, and a lot more, according to your wishes. Functioning with an estate planning attorney to finish and supervise this lawful paperwork can aid you in the following 8 areas: Estate preparing lawyers are experts in your state's trust fund, probate, and tax legislations.

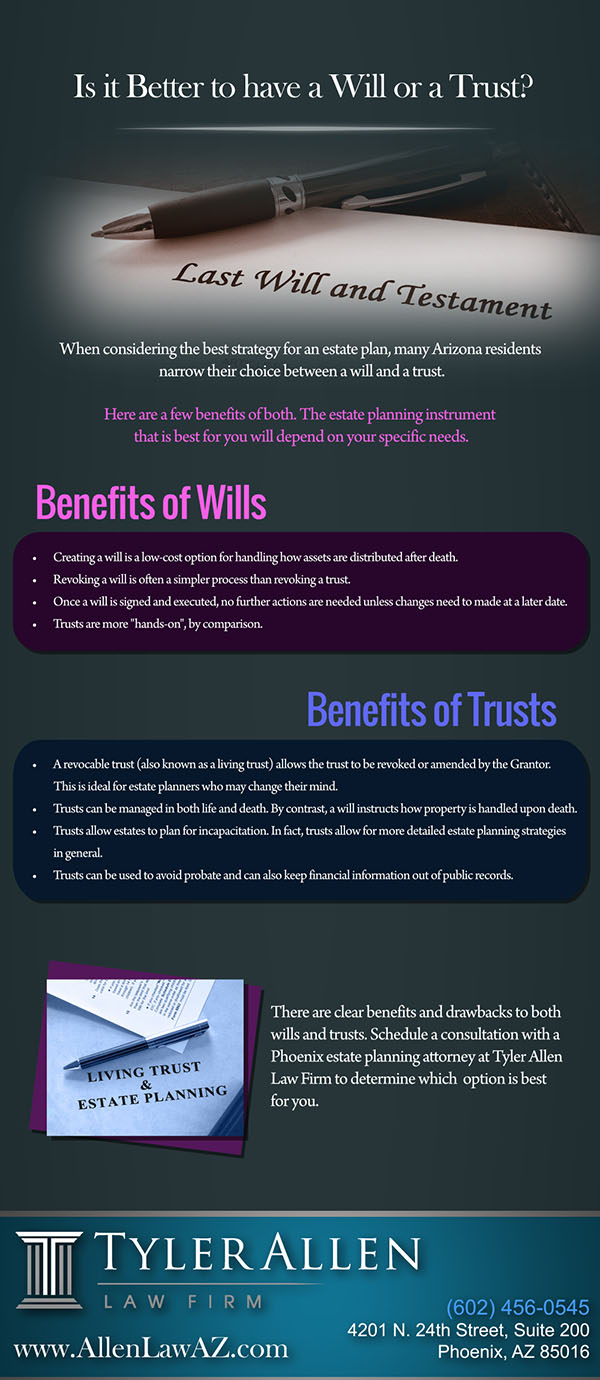

If you do not have a will, the state can determine how to split your properties amongst your heirs, which may not be according to your dreams. An estate preparation attorney can help organize all your lawful records and disperse your assets as you wish, potentially preventing probate.

The Definitive Guide for Estate Planning Attorney

When a client passes away, an estate plan would certainly determine the dispersal of properties per the deceased's instructions. Estate Planning Attorney. Without an estate strategy, these decisions may be entrusted to the near relative or the state. Tasks of estate organizers consist of: Producing a last will and testament Establishing trust fund accounts Calling an administrator and power of attorneys Identifying all recipients Calling a guardian for minor children Paying all debts and lessening all tax obligations and legal costs Crafting guidelines for passing your worths Establishing choices for funeral setups Settling instructions for care if you become ill and are not able to make decisions Getting life insurance policy, special needs earnings insurance, and lasting care insurance An excellent estate plan should be upgraded on a regular basis as clients' economic circumstances, personal inspirations, and federal and state regulations all develop

Similar to any type of profession, there are features and skills that can aid you accomplish these objectives as you work with your customers in an estate planner duty. An estate planning career can be ideal for you if you possess the complying with traits: Being an estate organizer implies assuming in the long term.

Estate Planning Attorney Things To Know Before You Buy

You have to aid your customer expect his or her end of life and what will happen postmortem, while at the same time not dwelling on morbid ideas or feelings. Some clients may become bitter or distraught when contemplating fatality and it might be up to you to help them through it.

In case of fatality, you may be expected to have numerous discussions and ventures with enduring relative concerning the estate strategy. browse this site In order to stand out as an estate planner, you might require to stroll a fine line of being a shoulder to lean on and the individual counted on to connect estate planning matters in a prompt and expert manner.

tax obligation code changed hundreds of times in the 10 years in between 2001 and 2012. Anticipate that it has been modified even more given that then. Relying on your client's monetary revenue bracket, which might evolve toward end-of-life, you as an estate organizer will have to maintain your customer's possessions completely legal compliance with any type of neighborhood, federal, or worldwide tax moved here obligation laws.

The Best Strategy To Use For Estate Planning Attorney

Acquiring this qualification from companies like the National Institute of Qualified Estate Planners, Inc. can be a solid differentiator. Being a member of these expert groups can confirm your abilities, making you more attractive in the eyes of a possible customer. In addition to the emotional reward helpful customers with end-of-life planning, estate planners enjoy the advantages of a steady income.

Estate planning is a smart thing to do no matter of your present wellness and monetary status. The very first important point is to hire an estate preparation attorney to assist you with it.

A seasoned attorney understands what details to consist of in the will, including your beneficiaries and special factors to consider. It additionally offers the swiftest and most efficient approach to move your assets to your beneficiaries.

Report this page